Leonardo and the Growing Sleeper Crisis

Another day, another new Leonardo drawing – this time a St. Sebastian with a mismatched verso and recto, with as many legs as a millipede, and lashed in a gale-force wind to a tree set in a landscape of icebergs…

Above, Fig. 1. A newly proposed Leonardo whose problems will be the subject of our next post. See Scott Reyburn’s “An Artistic Discovery Makes a Curator’s Heart Pound”, the New York Times, 11 December 2016.

The old masters world is bursting with Leonardo “discoveries” that flaunt their five-century no-histories. (See Problems with “La Bella Principessa”~ Parts I, II and III; and, “Fake or Fortune: Hypotheses, Claims and Immutable Facts”. “Problems with La Bella Principessa ~ Part I: The Look”.) At the same time there is a near meltdown over a spate of recent high quality exposed fake “sleepers” and “discoveries”. Sotheby’s has hired its own in-house technical analyst to spot inappropriate materials in new-to-the-scene old masters so as to “help make the art market a safer place” (“FBI expert to head up Sotheby’s new anti-forgery unit”, 6 December 2016, the Daily Telegraph). This is no bad thing and the appointment has been universally welcomed when, following the fake Frans Hals affair, it is reportedly feared that 25 forgeries sold for up to £200million are on the walls of unsuspecting owners, and when the new Sotheby’s appointee had himself single-handedly unmasked 40 supposed modern masterpieces sold for £47million at the now deservedly gone Knoedler Gallery, New York.

The real crisis, however, is the product of failures of judgements even more than failures to carry out due diligence checks on the material components of works. It remains the case that aside from works instantly disbarred by technical diagnosis, identifying authorship and establishing authenticity will necessarily and inescapably continue to be a matter of professional judgement. (We hold that here is systemic methodological flaw in appraisals that has yet to be addressed.) Meanwhile, dealers, critics, scholars and collectors embarrassed by suspected fakes are left agonising: should they concede error and take a hit on credibility but thereby limit damage, or should they stand firm and double the risks?

Even professional sleeper-hunters are falling out in acrimonious fashion over rival BBC television platforms – sorry, programmes – with one said to believe the other jealous of his good looks and success: “It’s a copy: Fake or Fortune? Stars try to halt rival show”, Richard Brooks, Sunday Times, 4 December 2016.

One auctioneer shouts you’ve ruined my sale at a musical scholar on Radio4. “Sotheby’s view is shared by the majority of world renowned Beethoven scholars who have inspected the manuscript personally”, the Sotheby’s man insists when characterising a scholar’s refusal to come in to view the manuscript as “irresponsible” (“Sotheby’s give Beethoven expert an earful after copied manuscript row scuppers sale”, The Times, 30 November 2016.)

The charge is a red herring, we say: if errors in the manuscript are visible in an auction house’s high quality photographs, coming in to touch the paper will not make them go away. If the auction house’s (anonymous) world authority musical experts think there are no errors, we add, they should come forward and say so. A Cambridge professor of musical theory did step forward to affirm his endorsement of the manuscript but he also admitted having been bothered by an anomaly (“Sotheby’s expert admits doubts over Beethoven script”, The Times, 3 December 2016.) To Sotheby’s likely mortification, it was revealed that arch-rival Christie’s had refused to sell the score last year, after being unable to confirm its authenticity – “Beethoven manuscript row remains unfinished”, the Daily Telegraph, 30 November 2016: “There was some good news for Sotheby’s however as the auction house succeeded in breaking a new auction world record for another musical manuscript…Gustav Mahler’s complete Second Symphony (the ‘Resurrection’), written in the composer’s own hand…went for £4,546,250.”

“Sotheby’s catalogue was an artful dodge, claims Russian billionaire” – the Times, which reported on 8 December: “Mr Ivanov said that honest mistakes were understandable. The problem is at Sotheby’s the fakes are listed as the top lots and are published”. With experts in as much disarray as auction houses and dealer/broadcasters, what perfect timing, then, for the appearance of a new, cool and calm legal anatomy of the sleeper phenomenon and its associated problems of authentication.

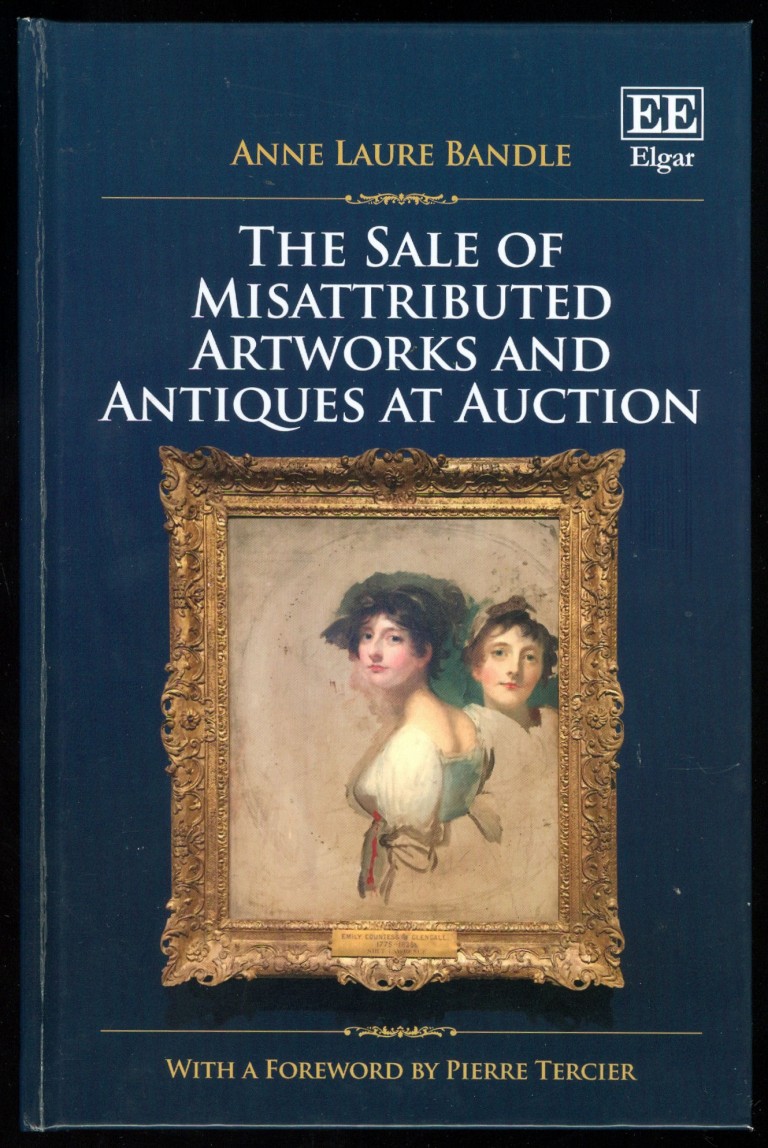

Above, Fig. 2. In “The Sale of Misattributed Artworks at Antiques at Auction” by Anne Laure Bandle of the London School of Economics and a director of the Art Law Foundation (Geneva), we encounter a book greatly richer and more urgently required than what is simply “said on its tin”. This work, the product of a PhD at the LSE, deftly turns over the law with regard to art market workings as encountered and applied under three key (for the art market) systems of law, those of Swizterland, England and the United States. Under all three it is shown how the auctioneer’s primary duty is to the seller (the consignor) not the buyer. It follows therefore that failing to identify the proper status of a work of a work when conferring an attribution can/should carry penalties of compensation to the consignor. However, in response to this duty/financial danger, auctioneers insert massive disclaimers of liability into their contracts and attributions. These disclaimers are also widely appreciated in terms of warnings to buyers of a need to satisfy themselves of the validity, accuracy and reliability of any catalogue description before buying. Such self-protective clauses have consequences that can bite hard on those who apply them. For one thing, we would add, forgers have not been slow to notice them.

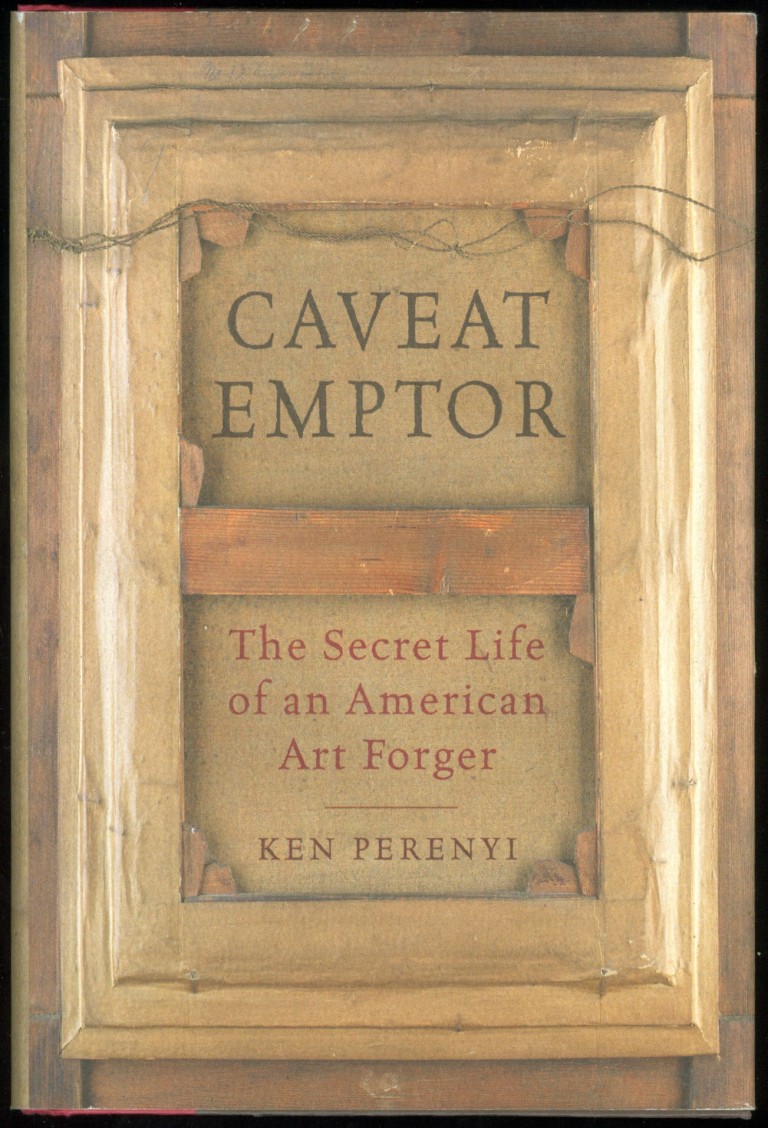

Above, Fig. 3. The American Ken Perenyi, cheekily called his 2012 Forger’s Memoir Caveat Emptor – The Secret Life of an American Forger. With little interest in consignors’ rights – he being both the knowing maker and the eager consignor of forgeries – Perenyi, after first studying the terminology of attributions in London auction house catalogues (“Attributed to; Signed; Studio of; Circle of; Manner of…”) swiftly moved to “Conditions of Business”; “Limited Warranty”; and thence “Terms and Conditions”. He reported (pp. 228-247) that when in London he noted that:

“In what can only be described as a masterpiece of duplicity, the terms and conditions made it clear (that is, if one has a law degree) that they warranted and guaranteed absolutely nothing. However, farther down, a paragraph entitled ‘Guarantee’ made it plain for even the most thickheaded. It stated: ‘Subject to the obligations accepted by Christie’s under this condition. Neither the seller Christie’s, its employees, or agents is responsible for the correctness of any statement as to the authorship, origin, date, age, size medium, attribution, genuiness, or provenance of any lot.’”

On return to the United States he then examined New York auction house catalogues: “Again and again we saw the phrase neither Christie’s nor the consignor make any representations as to the authorship or authenticity of any lot offered in this catalogue. ‘Hell, they don’t guarantee anything [over] here either!’ I said.”

After reading a paragraph on forgeries stating that if within five years of a sale the buyer could establish “scientifically” that a purchased painting was a fake, the “Sole Remedy” would be a refund of monies paid [- But for a cautionary case-in-point today, see UPDATE , below] Perenyi concluded the following: “A) Virtually nothing sold here was guaranteed to be what it claimed to be, B) Neither the auction house nor the seller assumed any responsibility whatsoever, C) Even if a buyer discovered a painting to be an outright fake, all he could do was ask for a refund, I came to the conclusion that this was an engraved invitation to do business.”

His late partner, José, concluded “Well, maybe we could save people the trouble of going to London and sell them [Perenyi’s forgeries] right here!”

In her new book, Dr Bandle carries the full terms and conditions of three auction houses (Christie’s, Koller Auctionen’s and Sotheby’s) as an appendix. She notes that notwithstanding disclaimers, such is the volume and reach of art sales that many art market players take auction house catalogues as reference points on the identification and evaluation of art and antiques and do so particularly with regard to attributions, confidence in which confers authority and engenders trust. In this regard the “sleeper”, as an under-identified and therefore under-valued work, is a special problem. A (conceptually subtle and fascinating) chapter is devoted to the sleeper’s elusive and problematic character. In fact, a delight of this book is its constant precision, economy and deftness of language in what is a perpetually shifting and re-forming arena where the market structures have both democratised and globalised the ownership of art but where buyers gathered from around the globe must compete in heated races to acquire multi-million valued art in spectacular shows of competitive bidding that are over in minutes. In a recent double television celebration of Christies-in-the-World, the term “buyer’s remorse” was heard in counterbalance to auctioneers’ seductively whispered advice to “think how terrible you will feel tomorrow if you don’t get this”.

A “sleeper” is first identified as being not a legal term but a figurative illustration of a legal problem. It is one that fleshes the notion that an artwork can remain a “dormant treasure” until it is properly identified. If not so identified, it stands dangerously (to auctioneers, and expensively to consignors) as a work that has been “undervalued and mislabelled due to an expert’s oversight and consequently undersold”. Sleepers are products of three types of error and each receives its own section. The extent to which restorations aiming and claiming to recover original conditions may alter objects and mislead authenticators is examined.

(But for our specialised concerns, recognition of the inherently problematic nature of restoration’s role in the identification and subsequent elevation of authenticity is a rare instance of under-examination in this book. Stripping off later materials does not in itself recover original states. It may disclose little more than badly damaged remains of an earlier, more “authentic” state. How much repainting, or “retouching” as it is euphemised, should be considered permissible before a worked-over sleeper approaches a forged recovery of authenticity? – See “A restorer’s aim – The fine line between retouching and forgery”.

It should be said that sensitivity in this arena is not an art market-confined problem: the Frick Museum does not publish the photograph below – Fig. 6 – of a stripped-down, not-yet repainted Vermeer that the Getty Institute holds and makes freely available – and many museums, in our experience, sit on photographs of their own restoration-wrecked paintings.)

Dr Bandle’s section on the relationship between sleepers and fakes or forgeries, between the unrecognised and the counterfeit, is adroitly introduced: “sleepers are the negative reflection of counterfeits: both are held as something that they are not.” Fine distinctions are drawn between a fake and a forgery. Both are characterised “negative concepts, referring, as they do, not to qualities but to their absences.” Before considering the legal status of sleepers, a fascinating examination is made of the tools and methods of attribution. So examined, too, are the hoped-for instruments of probity, the best-practice and ethical codes for authentication and dealing. Like auction house terms and conditions, ethical codes are shown carry their own disclaimers: “Similarly, the Swiss Association of Dealers in Antiques and Art contains a disclaimer of the attribution and appraisal’s accuracy.” (One hears a Perenyi expletive of delight here.) As for auction houses, while they “issue attributions in sale catalogues, they are not considered to be formal authentication reports”, whatever weight they might carry in the market and for buyers.

The section on the “Essence of Attribution” might be considered essential reading for all art market players and commentators, not least because the art market “greatly relies on scholarship”, and such expert appraisal is uniquely challenged “by the peculiarities of the art world” – one of which is that however long debates rage, scholars themselves “may very well never achieve a consensus”, in which case, the circularity is complete: “scholarship cannot halt during the art object’s identification process by establishing an attribution, not even temporarily”. Like painting the Forth Bridge, attributing an art object can be “an ongoing undertaking that never settles”. Existing attributions are constantly subject to challenge or revision.

The law itself can seem helpless or exasperated in the face of art world processes. Elusive notions of authenticity tax judges as well as scholars. With regard to establishing the merit or applicability of warranties of authenticity or the diligence of experts, even the admission of testimony is problematic within both Swiss civil law and the English and United States traditions of common law. Swiss courts can commission reports and instruct experts to answer set questions. Under common law conflicting parties support their rival positions by calling rival and conflicting experts. Courts may confine these adversarial jousts to “that which is reasonably required”. Under US Federal rules courts may exclude what they consider “unreliable expert testimony” and even when testimony is based on scientific principles it may be held acceptable only when these principles have “gained general acceptance”.

Under Swiss, English and United States jurisdictions alike, contractual relationships governing art auction sales are not clearly defined by law and are subject to scholarly debate (which, as mentioned, is a never-ending process). Further complications arise from the dual and conflicted position of the auctioneer. Does he really serve the buyer’s or the seller’s interest – or, somehow, both? In practice, we might think, he should/must aim to serve both since different people must always be persuaded any moment that it is a “good time” to sell and a “good time” to buy. Failures to recognise “sleepers” are the mirror image of failures to recognise fakes or forgeries: the one injures consignors’ interests, the other those of the buyer. But how to stay out of trouble as an auctioneer when case law results in unclear and unreliable notions of liability – and while there is a requirement to perform diligently but not one to produce to specific results?

By increments the law emerges as unfit for its presently allotted purpose in resolving sleeper disputes. Auctioneers are judged by standards predicated on what is little more than a fiction. Standards of performance must be interpreted on a case-by-case basis but these provide no benchmark in cases of sleepers sold at auctions. Aside from these problems, judges generally lack connoisseurship in art and art auction sales and may have difficulty in assessing authenticity and in reconstructing the attribution process – and while this is understandable because art connoisseurship and art market mechanisms are both highly sensitive and influential forces, judges, no matter how well educated and competent in other areas of the law, will struggle to redress a present structural imbalance between the interests of (favoured) buyers and (disfavoured) consignors.

Can applications of the law be made to work in this arena? Are alternatives to the law presently or potentially available? For answers to these questions it is necessary to read the concluding section of a timely book that will commend itself to Art’s players and watchers alike.

The Sale of Misattributed Artworks and Antiques at Auction, Anne Laure Bandle. ISBN: 978 1 78643 100 4 Price £100 or Web: £90

Michael Daley, 15 December 2016

UPDATE 17 December 2016

In the 17/18 December Financial Times “The Art Market”, Melanie Gerlis writes:

“ Art is notoriously a ‘buyer beware’ market, but even prolific professionals can get caught out. Micky Tiroche, a private dealer in London and co-founder of the Tiroche auction house in Israel, bought ‘Sun and Stars’, a gouache attributed to Alexander Calder, for £28,000 (with fees) at Bonhams, London in 2007. The purchase was made through his dealing company, Thomas Holdings, which has about 160 works on paper by Calder.

“In 2013, the gouache was submitted, along with other works, to the Calder Foundation in New York, which doesn’t officially authenticate the artist’s works but gives them an inventory number (known as an ‘A-number’ because the digits are prefixed with the letter A). ‘Sun and Stars’ was not given an A-number, making it effectively unsellable.

“Christie’s, Sotheby’s and now Bonhams will not sell Calder works that do not have an A-number.

“Tiroche, who buys frequently at Bonhams as well as elsewhere, says that he asked the auction house for a refund and was refused. He has suggested alternative, less visible ways of refunding (such as deducting its value from other works) and legal letters have been exchanged, but to no avail.

“A spokesman for Bonhams said: ‘It is [the auction house’s policy] not to discuss individual cases, beyond saying that we are in communication with Mr Tiroche’s company about the situation.”

Leave a Reply